Your cart is currently empty!

One or two people, HSBC Holdings PLC and you can The fresh Century Economic, disclosed early in March improved terms for losses into subprime money

The fresh new slowdown on housing industry you to definitely first started at the beginning of 2006 deducted over a portion part away from GDP increases inside next half of a year ago. Now, during the 2007, experts features stated that the terrible of one’s housing lag are more than. Yet not, early in February, more severe difficulties emerged regarding the subprime mortgage industry, new quick development of and this supported the latest afterwards degree of one’s casing increase when you look at the 2005 and 2006. Subprime mortgage loans was high-risk fund payday loans West Virginia so you can weak consumers exactly who often have to obtain the new advance payment on the a property buy, leaving all of them with home loan obligations equal to 100 percent of one’s purchase price.

Brand new inventory price of The newest Century Financial, which had been floating all the way down, which have fallen from the in the 15 % ranging from , stopped by thirty-six % per day on , whenever their subprime lending difficulties emerged. Because of the March 9, The fresh Century shares were off 46 percent towards the 12 months.

The fresh weakest subprime funds try monitored during the a card industry list referred to as ABX Subprime directory you to definitely tunes fund ranked Bbb-without. You to definitely index decrease 7 percent in one week early in March. Brand new ABX Better business bureau bequeath, the fresh pit anywhere between interest levels into the subprime loans and you will treasury ties, ran from around 250 foundation affairs (at the beginning of and also continued to go up.

Whenever you are problem money regarding the financial field was largely focused during the new subprime urban area, concern features wide spread to the latest housing market also. Costs from shares regarding S&P homebuilders’ business had rallied from the about 20 percent regarding , but then marketed out-of of the about ten percent within the week where difficulties began to arise with subprime mortgage loans. Said Jeffrey Mezger, leader from KB Home, a giant You.S. homebuilder: When the subprime tightens up and underwriting tightens upwards, it’s going to effect [housing] request.

The newest decisions of one’s subprime mortgage markets, at least regarding the weeks leading up to the fresh disclosure out-of so much more defaults early in , are normal of your own decisions of several classes of risky property, and loans so you can emerging locations and you may nonsense bonds from the business business. Brand new tradable securities yield a higher rate of go back than simply claims into the safer property and you may form a attractive financing retailer having executives who’re interested in higher pricing out of return and you can is less worried about risk. The fresh new commonly listed subprime conditions that are seen at the beginning of 2007 is, naturally, an expression from second thoughts that large productivity toward like mortgages could be paid back. The marketplace manifestation of even more shakiness from the subprime business try a-sharp upsurge in the rate paid towards securitized says thereon business, and that, therefore, shows elevated threats.

Clearly, the detected chance for the subprime funds has increased sharply

Given that offer-off risky possessions regarding rubbish-thread group to have propertiessubprime mortgage loanscould be contains, it is diagnostic regarding a wider topic linked with chance getting by the investors incessantly looking for high production. Information the implications demands an understanding of the rules about more exposure taking-in one framework.

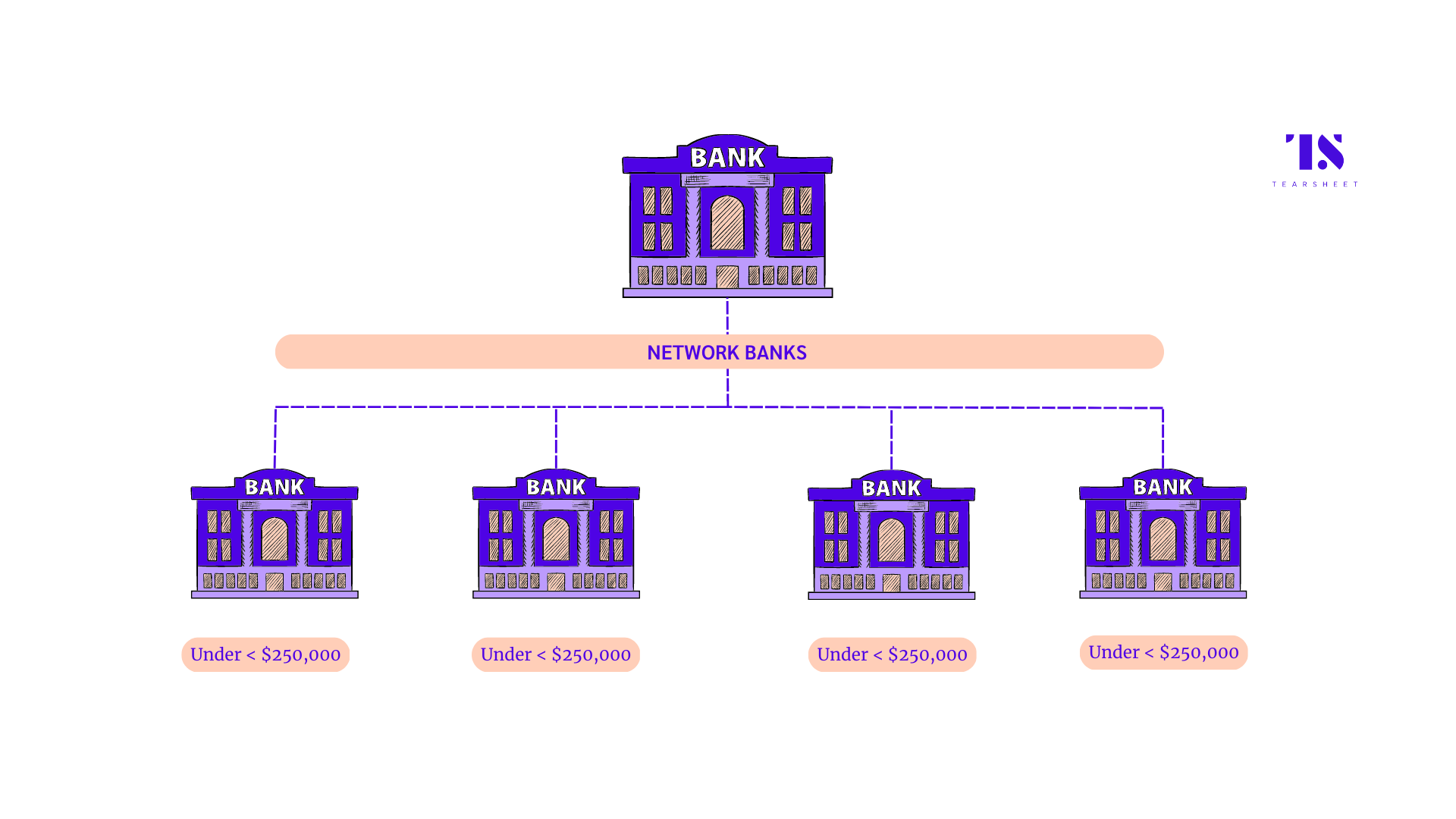

Subprime fund can be considered home-sector rubbish ties issued with the aid of specialist working in order to facilitate this new financing techniques and in order to repackage the newest subprime financing toward tradable ties

Taking on exposure means broadening financial investments having a larger selection of possible consequences, negative and positive, in the hope off capturing the greater self-confident effects versus distress too many of one’s negative of those. Based on Peter Bernstein, The word risk’ comes regarding very early Italian risicare, which means to challenge.’ Buyers daring so you’re able to risk bad consequences predict, an average of, to make higher costs out of get back. Highest expected production should make up traders to own and in case way more exposure. They’re not, naturally, an ensure that bad outcomes will not exist.